- Islamic Economy Newsletter

- Posts

- Halalbooking $5mn raise; Tightening Chinese halal imports; $49bn rev. of USA Muslim SMEs;

Halalbooking $5mn raise; Tightening Chinese halal imports; $49bn rev. of USA Muslim SMEs;

Assalamualaikum,

Islamic equity screening is at the heart of halal investing. This week’s editor’s pick unpacks how different screening frameworks across the Muslim world shape what counts as a halal stock and why consistency, transparency, and trust matter for global investors.

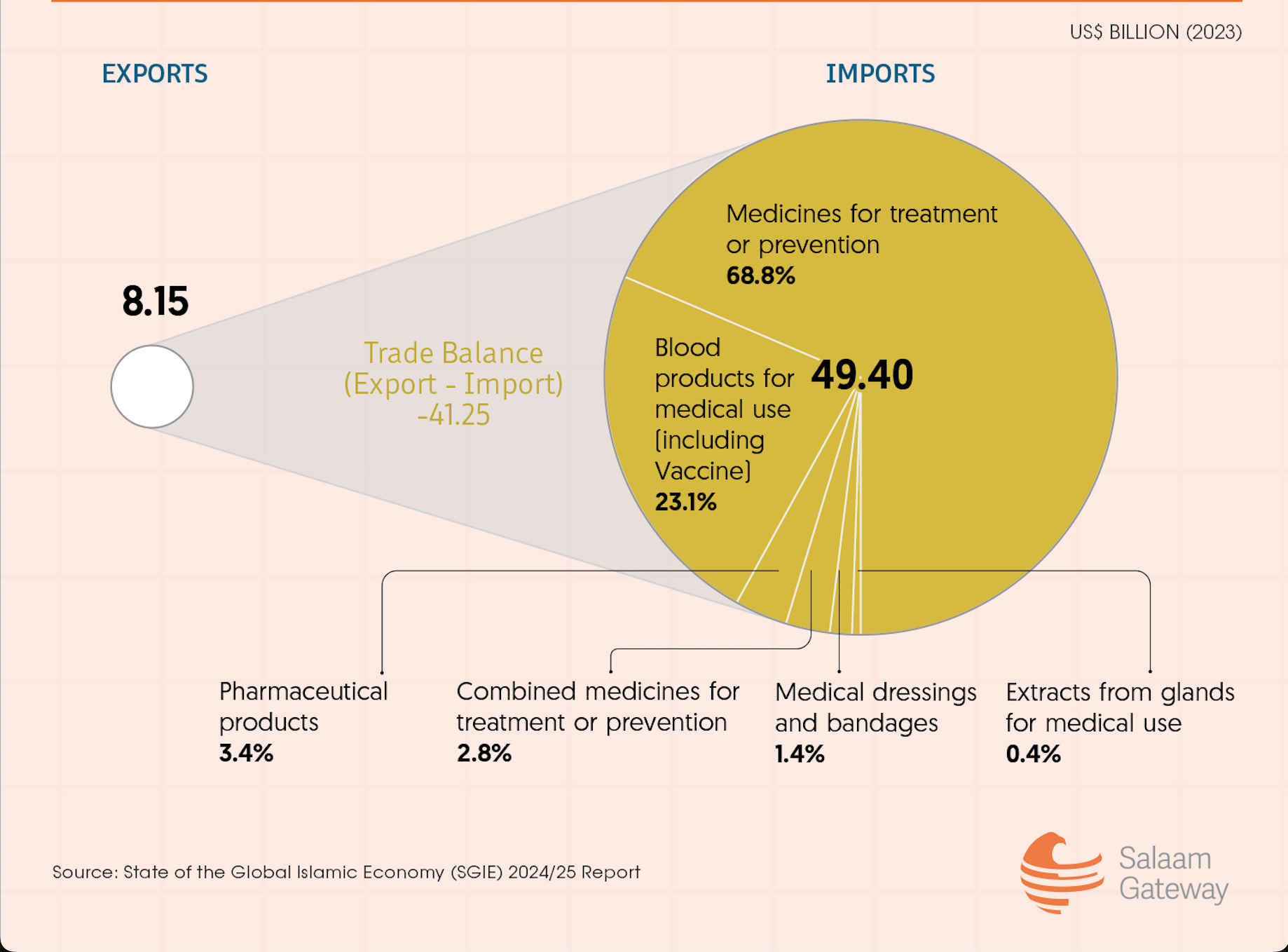

Saudi Arabia, the UAE, Türkiye, and Malaysia are leading efforts to reduce pharmaceutical import dependence by investing in AI, automation, and biotech to build self-sufficient, innovation-driven drug industries.

The Thrive 2025 – North America Muslim Market Report, produced by DinarStandard in partnership with Muslimi and the American Muslim Consumer Consortium (AMCC), reveals a $47 billion ecosystem of Muslim-led SMEs transforming the US and Canadian economies through innovation, entrepreneurship, and values-driven growth.

Meanwhile, Indonesia is stepping up checks on Chinese producers to ensure imported goods meet its halal standards and maintain consumer trust.

And finally in travel, UK-based Halalbooking has secured $5 million to expand its global reach, underscoring the growing demand for halal-friendly tourism experiences worldwide.

Recommended reads:

Infographics:

In other news:

Did you know?

Global commodity prices are projected to fall by about 7% in 2025 and another 7% in 2026, marking a fourth straight year of decline amid weak global growth, trade tensions, and ample oil supply.A message from 1440 Media:

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Your feedback matters:What did you think about today’s email? Your feedback is our guiding star to deliver top-notch content straight to your inbox. |